Since its official launch in late January in Ontario and Atlantic Canada, BMO’s BrokerEdge division has been making waves and slowly growing its presence in Canada’s mortgage broker channel.

The bank kicked off its return to the broker channel—following a 16-year hiatus—in a “small and very deliberate” way, Justin Scully, Head of BMO BrokerEdge, told CMT in a recent interview.

That involved working with a small group of brokers from DLCG (Dominion Lending Centres Mortgage Group) and M3 Group during its soft launch in January before expanding to a select group of brokers from TMG the Mortgage Group in early March.

“We have been in a controlled state with a very small group of select brokers to ensure that all the functionality is working as intended and that we can deliver on providing an excellent broker and customer experience,” said Paula Oliveira, BMO’s Regional Vice President, Ontario and Atlantic Canada. “That’s our main priority right now.”

Scully added that despite all of the team’s preparations in the lead-up to the launch, “we’ve learned a few things and we feel even better about coming back into the channel.”

“Basically we’ve been able to test the different intake points to make sure things worked with each network, each sub-network, each POS [Point of Sale], different deal types, and it’s all gone according to plan,” he added.

And so far, feedback from the bank’s broker partners has been positive.

Scully confirmed that BMO expects to be operating in the broker channel nationwide by fiscal 2026, with a West Coast roll-out up next.

Working to expand its product offerings

BMO has also confirmed that it is actively working to introduce more of its lending products and programs to the broker channel.

For now at least, access to certain specialty lending programs are only available through BMO’s proprietary channel. This includes the bank’s Canadian Defence Community Banking program, which caters to members of Canada’s armed forces, as well as BMO’s Homeowner ReadiLine, the bank’s revolving home equity line of credit (HELOC).

“We don’t have our HELOC product yet, but we will,” Scully confirmed, adding it should be available by the end of the year or early 2025. “I would say the risk appetite in both channels is the same. We do not have a different appetite by channel.”

Oliveira noted that broker clients do have access to some of the bank’s other popular programs, including its short-term rental financing program, which caters to services like Airbnb and is unique in the A-lending space.

Other programs include new construction financing, which uses the current appraised value of the property to determine the loan-to-value (LTV), and a program for high-net-worth clients that allows them to use liquid assets as an alternate source of down payment up to a maximum LTV of 80%.

“So products like this will give us the leverage to be very respected in the broker space,” Oliveira said.

In addition to these product offerings, BMO has also been promoting the benefits of its team of Welcome Advisors, who will connect with clients in the post-approval and pre-funding phase and work with them again post-funding.

“It’s about really understanding what the client needs and how can we help ensure they are in a better financial position after going through such a large purchase,” Oliveira said.

“The design decisions we’ve made around the welcome advisor team and the way we can help customers with all their other financial needs, and the way we envision that ultimately interfacing as a value add to brokers, has been really well received,” Scully added.

A focus on customer acquisition

Since it first publicly announced its return to the broker channel last summer, BMO has been open about its goal of building holistic relationships with customers rather than merely securing mortgage deals.

Interestingly, Scotiabank has recently embarked on a similar path, reporting that in the first quarter, 70% of its new mortgage deals involved clients who had multiple financial products with the bank. This move signals a broader industry trend of banks wanting to deepen their relationships with clients across various financial products and services beyond the traditional mortgage offering.

“This is about customer acquisition, not just mortgage acquisition for BMO,” Scully said. “And so, we’re looking for brokers who want to be with us on our journey to franchise customers, to take a mortgage customer and have a real, meaningful conversation about how we can help them across their financial needs.”

Scully acknowledges that it’s not a vision that will necessarily be shared by all brokers. “If our broker doesn’t support that and doesn’t understand that’s the most critical element for BMO, it’s okay,” he said. “So, there will be brokers for whom BMO BrokerEdge is not a fit, and we’re good with that.”

The brokers BMO wants to partner with

Once BMO BrokerEdge is fully expanded across the country, Scully said the bank will continue to be selective about the brokers it chooses to work with to maintain a focus on quality and BMO’s business objectives within the channel.

“We’re really transparent about what matters to us. We we want brokers that run a really clean business, with a propensity to do a lot of A-, bank-type business,” he said.

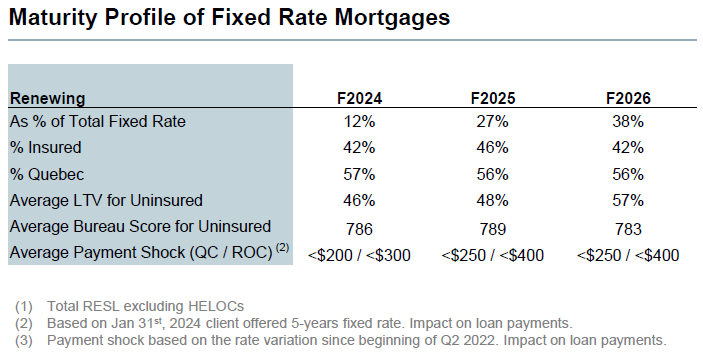

“We do know that in the broker channel there tends to be a little bit more focus on first-time homebuyers who tend to be a little bit more in default insured business,” he added. “And so, that’s certainly part of the approach and we intend to be very competitive in those spaces.”

Q&As

Both Oliviera and Scully addressed a variety of other topics during the interview, with some of the key highlights below.

- On the bank’s commitment to offering same-day pricing responses to brokers:

“Definitely one of our commitments to our customers and to the brokers is to be responsive and to have everything aligned for them in order to provide an answer to their clients,” said Oliveira. “I’m not that in the beginning everything is going to be perfect, because we are going through a transition, but that’s our objective.”

- On the reputation BMO is trying to build:

“We’re being really transparent with the brokers upfront. We’re going to do a lot of training on our appetite. What types of deals we like, what types we were less favourable, Because, if you’re going to meet a broker a year from now and you ask them about BMO, I want them to say we’re really efficient, we’re fast to yes, and we’re really reliable. And if they said those things, then I’d be thrilled.”

- On the bank’s plans to continue offering fixed-payment variable-rate mortgages in light of concerns from OSFI:

“As we evolve, we’ll evolve the same across channels. When we did a fixed-payment variable rate product we did it because, in a rising rate environment, it gives customers time and flexibility to manage payments, and that’s been proven right,” said Scully. “Customers can take voluntary actions, whether they make a lump sum payment or they increase their payment, and many are doing so prior to renewals so that they minimize the payment increase. And then in a declining rate environment, the benefit would be that they’ll pay off their mortgage sooner.”

This article was written for Canadian Mortgage Trends by: