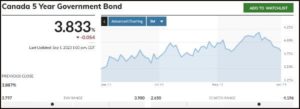

Mortgage providers across the country have been busy raising rates over the past week, and it could continue next week as bond yields continue to rise.

On Thursday, the Government of Canada 5-year bond yield briefly surged to an intra-day high above 4.41%. It pulled back slightly, but remains at a 16-year high.

As a result, mortgage providers—including RBC and TD Bank—have been hiking fixed mortgage rates across all terms by up to 30 basis points (0.30%).

“Higher fixed mortgage rates again next week if this keeps up,” tweeted Ron Butler of Butler Mortgage.

The role of risk “spreads”

In a note to clients, TMG The Mortgage Group broker Ryan Sims touched on the intricacies of mortgage rate pricing, including both the influence of bond yields as well as the spread banks apply to manage risk.

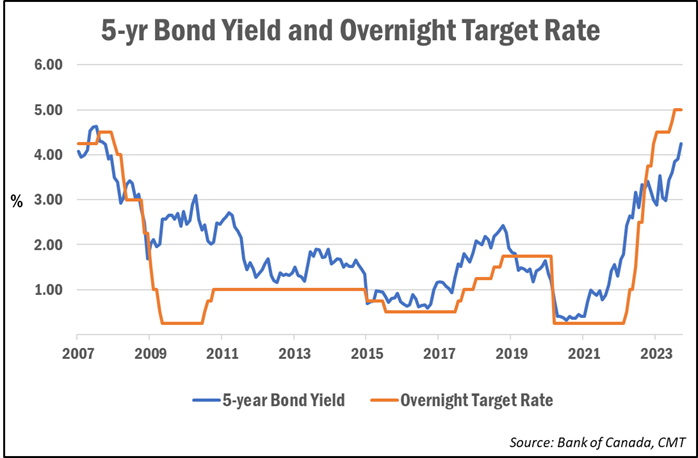

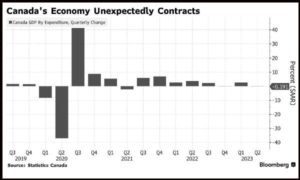

While lower interest rates are desirable, they often coincide with economic downturns—and occasionally an economic “train wreck,” as was seen during the 2008 Financial Crisi—resulting in banks increasing spreads to offset perceived risks.

“I would think that if we were to see any economic wobbles over the next 60 to 180 days, we would see bond yield start to drop,” he wrote. “[But] if we see bond yields drop quickly, I would expect the [higher spreads] to start to eat away at any—or all—of the savings.”

He pointed to March 2020 as an example. At that time, the Bank of Canada drastically cut its target overnight rate, yet 5-year fixed mortgage rates actually went up based on the risk at the time.

In other news…

Federal government increasing CMB program by 50%

The Canadian government has announced a significant increase in the annual limit for Canada Mortgage Bonds from $40 billion to $60 billion, unlocking $20 billion in new financing to facilitate the construction of an additional 30,000 rental apartments per year.

This initiative is part of a comprehensive strategy to address the surging housing costs and meet the growing demand for rental housing. The additional financing is designated for multi-unit rental projects, including apartment buildings, student housing and senior residences.

However, this expansion of the mortgage-bond program marks a temporary reversal of the government’s earlier proposal to phase out the program, leading to some market uncertainties.

Despite the program’s AAA-rating and government guarantee, the inconsistent signalling around its continuation and size has raised concerns among market participants.

RBC: Government’s GST measure no “silver bullet”

Earlier this month the federal government announced the elimination of GST on new rental construction in an effort to encourage developers to pursue purpose-built rental apartment projects.

While the move is expected to “improve the financial viability” of such construction projects, a report from RBC Economics said that it “won’t be a silver bullet” insofar as delivering new supply to the rental market.

This is due to the “severe deficit position” the rental market finds itself in, as well as the fact it will take time to get such projects off the ground and complete, noted report author Rachel Battaglia.

“More policy action—at all levels of government—will be needed to really move the needle on rental supply and affect rent,” she wrote. “This includes modernizing zoning by-laws to accommodate high density development, streamline the permitting prices for new construction, and ensure other fees, taxes, and policies are in line with the broader goal of expanding the rental housing stock in Canada.”

B.C. government unveils measures to speed up homebuilding

In an effort to speed up the pace of homebuilding in British Columbia, the provincial government has unveiled two new initiatives, including the Single Housing Application Service (SHAS) and the Home Suite Home guide.

SHAS aims to streamline permitting for builders, potentially cutting timelines by two months, while the guide assists homeowners in developing secondary suites. A pilot program, launching in spring 2024, will offer forgivable loans up to $40,000 for below-market rate secondary suites.

“We are going at this problem from all different directions, because that’s what it requires,” Premier David Eby said. “People in our province deserve a decent place to live they can actually afford to rent or buy, but a chronic housing shortage and long permit approval times are frustrating that achievable goal.”

The initiatives have garnered industry support but also faced criticism regarding their substance and potential bureaucracy. These measures, part of the Homes for People action plan, prioritize diverse housing solutions, including social and Indigenous housing, and aim to leverage approximately 228,700 units eligible for conversion into secondary suites across the province.

RBC’s $13B acquisition of HSBC approved by Competition Bureau

The Royal Bank of Canada (RBC) has received approval from the country’s Competition Bureau for its $13.5-billion acquisition of HSBC’s Canadian unit.

The deal, marking RBC’s largest acquisition, will see the bank, already Canada’s largest with 1,200 branches and $1.8 trillion in assets, acquire HSBC Canada’s 130 branches and $134 billion in assets.

The Competition Bureau did say the deal would “result in a loss of rivalry between Canada’s largest and seventh-largest banks.”

The deal, while still subject to further regulatory approvals, is expected to close by the end of 2023. The implications of the deal on HSBC’s mortgage products remain uncertain. HSBC has consistently offered market-leading pricing among the big banks for select mortgage terms.

When the acquisition was announced in November 2022, RBC CEO Dave McKay had called it a “unique and once-in-a-generation opportunity,” adding it would position RBC as the “bank of choice for commercial clients with international needs, newcomers to Canada and affluent clients who need global banking and wealth management capabilities.”

This article was written for Canadian Mortgage Trends by: