With credit growth grinding to a near halt and delinquency rates on the rise, it’s clear that Canadian borrowers are feeling the pinch of high interest rates and a slowing economy.

Yet, CIBC Deputy Chief Economist Ben Tal sees some silver linings amidst these challenges, which he says suggest we’re heading for more of a spending freeze rather than a large credit risk event.

First, let’s look at some of the concerning trends taking place in Canada’s credit market right now.

At the forefront is the dramatic slowdown in credit growth to levels not seen since the double-dip recession of the 1980s.

This slowdown is particularly pronounced in the mortgage sector, where the sensitivity to rate hikes has led to a dramatic decrease in new lending activity to what Tal says are recessionary levels.

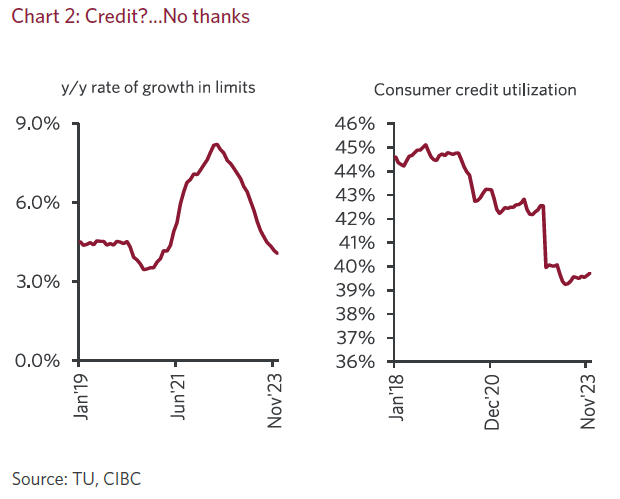

“The speedy and aggressive slowing in the pace of credit growth reflects both supply and demand forces,” he writes, pointing to Bank of Canada data showing a tightening of credit availability compared to during the pandemic. “The year-over-year growth rate in credit limits available to households is now rising by half the pace seen in mid-2022 and below the pre-pandemic rate. In real terms, limits are hardly growing.”

Households are also more reluctant to use that available credit, Tal adds, with utilization rates falling in recent months.

Incoming wave of mortgage renewals

Additionally, delinquencies are on the rise, signalling increasing financial stress among borrowers. Tal notes that arrears are rising across various forms of consumer credit, from credit cards and auto loans to mortgages.

As has now been widely reported, challenges for mortgage borrowers are only expected to intensify in the coming years due to the large number of low-interest rate fixed terms that are set to renew.

CIBC’s research suggests 50% of outstanding loans have reset to higher rates, which still leaves more than $1 trillion worth of mortgages to renew in the coming years.

“Based on term distributions and our interest rate forecast, we estimate that the average interest payment shock in 2024-26 will amount to around 15% a year,” Tal writes. However, he says the key word is “average,” with some borrowers who are now in shorter terms seeing their rates actually fall in the coming years, and others experiencing a much sharper payment shock.

The average “masks the pain at the margins — where credit risk resides,” Tal notes.

While one has to “dig deep” to find early signs of credit vulnerability, Tal says they do exist. Early-stage delinquencies in the below-prime mortgage space are “rising strongly;” non-mortgage debt held by homeowners is well above 2019 levels with half of all mortgages yet to be repriced; and renters are being impacted to a greater degree by the weakening labour market and rising rents.

Reasons for optimism

Against this backdrop, Tal has found some silver linings that suggest we may be headed for more of a “squeeze on spending” as opposed to a “large potential credit risk event.”

For one, while insolvencies are up over 20%, Tal says they’re rising from a “very tame” level. Additionally, a record high of 80% of those insolvencies are proposals, which involve restructuring the debt, rather than outright bankruptcies.

“That’s important because the legal costs and the losses per proposal are lower for lenders than in bankruptcies, and the recovery rate is much higher,” he says, meaning financial institutions aren’t seeing their loss rates spike.

There also appears to be “increased communication and coordination” between lenders and borrowers based on the fact that 30- to 60-day delinquencies are rising, while the share of those moving to the 60- to 90-day category is actually on the decline.

“Also encouraging is the fact that the share of mortgages that are in a trigger rate

position (a situation in which interest payments account for 100% of debt service payments) has been falling steadily in recent months,” Tal adds. “That early treatment of the symptoms was not seen in previous recessions.”

The bottom line? Yes, there are signs of stress among borrowers—both homeowners and renters alike—and delinquencies are expected to continue to rise in the coming quarters.

“But the fact that we had to dig deep to find signs of stress, combined with our expectations that the unemployment rate will not exceed 6.5%—miles below the rate seen during recessionary periods in the past, means that upcoming credit losses will be manageable,” Tal says.

This article was written for Canadian Mortgage Trends by: