A recent report has found Canadian seniors are choosing to age in their homes for longer, with many not selling their home until their 80s and 90s.

The findings were revealed in the Housing Market Insight Report by the Canada Mortgage and Housing Corporation (CMHC), which explored some of the expected implications on housing supply in the coming years.

According to the CMHC, more seniors are potentially staying homeowners well into their later years because many are simply living longer, healthier lives and can handle the maintenance of a home.

The study, which focused on elderly Canadian households in the country’s six largest cities, also identified differences based on location. For example, households in Toronto and Vancouver are the most likely to transition to condominiums as they age, where in Montreal there’s a preference for moving to rental housing.

“In Canada, the financial wealth of elderly households may also vary from one urban centre to another,” says the CMHC in its report. “Affluent households may therefore be able to remain homeowners and purchase a home that meets their needs, rather than rent one.”

Canadian seniors are most likely to sell in their nineties

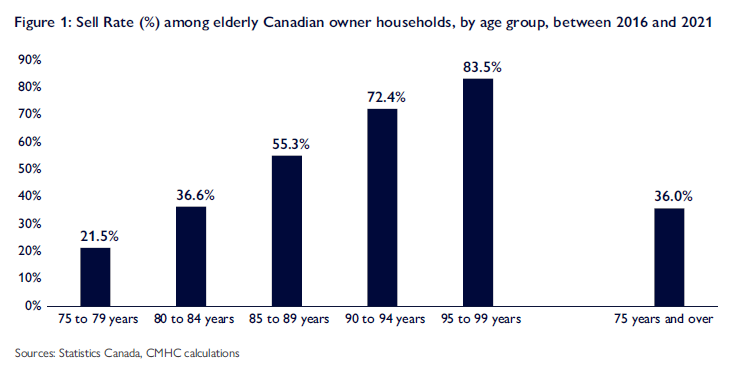

Canadian household census data show an estimated exponential sell rate trend amongst seniors from 2016 to 2021. Following consecutive cohorts over time, the data show a higher prevalence of significantly older seniors selling or giving up their homes compared to younger seniors.

CMHC defines the sell rate as the ratio of homeowners who sold their properties to the total number of homeowners for that particular demographic. For example, between 2016 and 2021, 100,500 homeowners aged 75 to 79 let go of their properties out of an initial total of 466,775 owner households, resulting in a sell rate of 21.5%.

CMHC adds that the sell rate for households aged 75 and above has been trending downward since the early 1990s, falling on average six percentage points in that time.

Based on these calculations, the data show most Canadians wait until they’re in their nineties to give up their home.

Cohorts that are approaching or in their 90s are expected to sell their homes and potentially open up additional housing supply to the market in the coming years.

“They might, for example, decide to rent private housing or, for health reasons, move into public housing (such as a care centre for seniors),” the CMHC report says. “Deaths are another factor that brings properties onto the market.”

What does this mean for Canadian housing availability?

While CMHC says it will still take a few years to have older seniors list their homes on the market, the result has the potential to eventually increase housing supply and subsequently narrow the affordability gap in Canada.

The result “seems to indicate that the number of units sold by elderly households might increase more rapidly once population aging in Canada is more advanced,” CMHC said. “In other words, when the number of households over age 85 grows larger.”

According to projections from Statistics Canada, population growth in the 85-and-over age group will rise more rapidly from 2030 to around 2040 due to the first baby boomer cohorts reaching this age group.

For now, it may be a waiting game to see if and when housing supply increases as expected.

“The big question is whether, in the coming decades, elderly households will follow in the footsteps of previous generations or go their own way,” says CMHC. “For example, will aging in place become more popular with seniors? Will the recent rise in rental housing starts in various CMAs across the country encourage more senior households to opt for renting?”

Until then, restoring housing affordability in Canada will largely depend on how senior household sales unfold in the near future.