National Bank of Canada, the country’s sixth-largest bank, saw a rise in mortgage delinquencies during the first quarter, with the largest increases contained to its insured variable-rate mortgage portfolio.

The bank reported the percentage of residential mortgages that are behind on payments by at least 90 days rose to 0.13% in Q1, up from 0.11% in Q4 and just 0.8% a year ago.

However, it’s the clients with variable-rate mortgages, who represent 28% of the bank’s $91.3 billion residential mortgage portfolio, that are finding it most challenging to keep up with their payments.

National Bank, like Scotiabank, offers adjustable-rate mortgages, where the borrower’s monthly payment fluctuates as prime rate changes. As a result, the bank’s floating-rate clients have already experienced payment shocks brought on by the sharp rise in interest rates over the past two years.

Its fixed-rate clients, on the other hand, will only see their interest rates increase at renewal time.

The delinquency rate for National Bank’s variable-rate clients jumped to 0.21% of its portfolio from 0.14% in Q4 and 0.07% in Q3. That’s now on par with its pre-pandemic rate of 0.21% reported in Q1 of 2020.

“Variable-rate mortgage delinquencies have continued to normalize as borrowers have absorbed a significant increase in interest rates,” Chief Risk Officer Bill Bonnell said on the bank’s earnings call this week.

“Where the delinquencies have…increased the fastest is where there’s been more leverage in the consumers,” he added, pointing to the delinquency rate of 0.32% for its insured variable-rate borrowers vs. 0.17% for their uninsured mortgage counterparts.

“Typically the insured mortgage holder is a first-time buyer [who] doesn’t have the 20% down payment,” Bonnell added. “And so, it’s not a surprise that we see a differentiation between the delinquency trends for insured…and uninsured variable rate [mortgages].”

Looking ahead to fixed-rate renewals

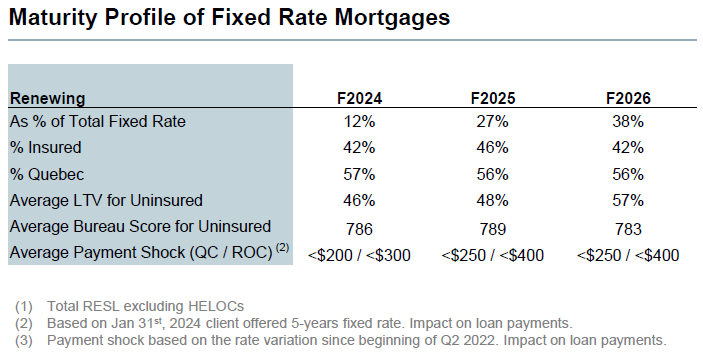

As for the the bank’s fixed-rate mortgages, just 12% of its portfolio will be coming up for renewal in 2024, with the bulk of renewals coming in 2025 (27%) and 2026 (38%).

National Bank estimates those with renewals this year will face a payment increase of around 15%, or between $200 and $300. Those renewing in 2025 and 2026 are likely to see slightly higher payment increases of 22% and 18%, respectively, or between $250 and $400.

“As we look ahead at what will happen upon renewal for the fixed rate mortgages, there are a lot of metrics…which give comfort.,” Bonnell said.

“When you look at the nature of those fixed rate mortgages for 2025 and 2026 renewal, there’s a high percentage which are insured [and have] a relatively low loan-to-value, which provides flexibility for the borrower or depending on where rates are at the time,” he continued, saying they typically have high credit scores as well. “So, we’re quite confident in the resiliency of those borrowers.”

Quebec borrowers show greater resiliency to payment shocks

Bonnell also addressed some regional differences, noting that delinquencies on average are lower in Quebec.

“In our portfolio, we do see Quebec consumers appearing to have more resilience and [are] performing better on a delinquency basis,” he said.

He pointed to lower average home prices in the province, which means “lower mortgages, so less consumer leverage, more dual incomes [and a] diversified economy.”

“It generates factors that support resiliency in our mortgage borrowers and that’s coming through in the numbers,” he added.

National Bank earnings highlights

Q1 net income (adjusted): $922 million (+5% Y/Y)

Earnings per share: $2.59

Conference Call

- “Growth in personal loans remained slower, reflecting a lower level of mortgage originations. We will continue to be disciplined across our portfolio, balancing volume growth with margin and credit quality,” said President and CEO Laurent Ferreira.

- “Looking ahead, we expect delinquencies and impaired provisions to continue their upward path,” said Chief Risk Officer Bill Bonnell.

- National Bank’s base case economic forecast has the unemployment rate in Canada increasing to about 7% by early 2025.

- “Credit card delinquencies now exceed their pre-pandemic level. Within this population, we find the client segment most impacted has been non-homeowners, a segment that has been absorbing significant increases in rental costs,” Bonnell said.

Source: NBC Conference Call

Note: Transcripts are provided as-is from the companies and/or third-party sources, and their accuracy cannot be 100% assured.

Feature image: Roberto Machado Noa/LightRocket via Getty Images

This article was written for Canadian Mortgage Trends by: